Are you thinking about becoming a Chartered Accountant (CA) after graduation? You’re not alone. Many students choose to pursue CA after completing their degree because it offers a stable, respected, and well-paying career.

A Chartered Accountant plays an important role in managing finances, audits, taxes, and business advice for companies and individuals. It is one of the most in-demand and trusted professions in India and around the world.

The good news is that if you’re a graduate, you can directly enter the CA course through a special route called the Direct Entry Scheme. This saves you time compared to students who start after 12th.

In this blog, we’ll guide you step-by-step on how to become a CA after graduation, what qualifications you need, how the course works, and what exciting career opportunities await you after qualifying.

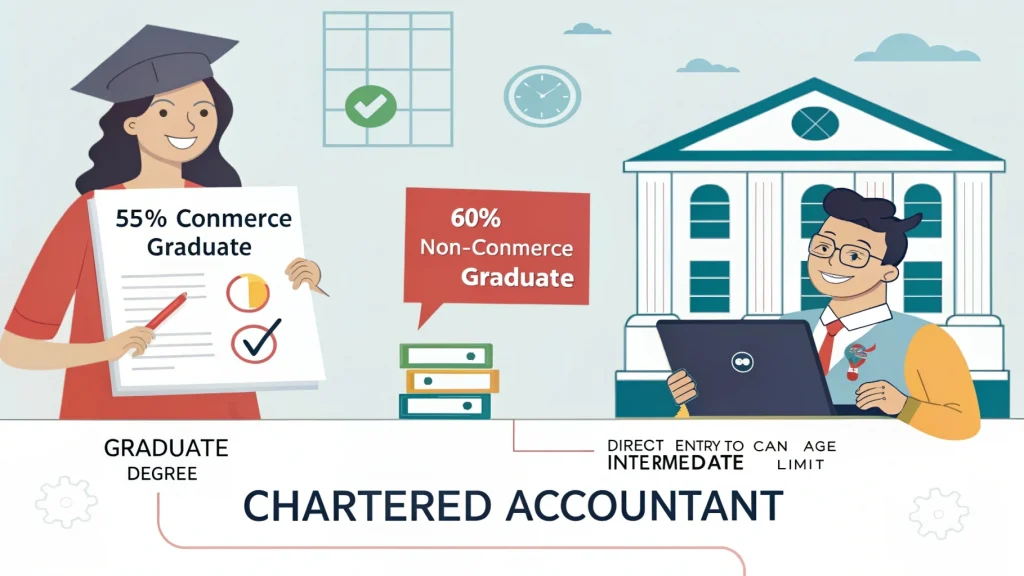

Eligibility Criteria for Graduates

If you want to become a Chartered Accountant after graduation, you must meet the following basic eligibility requirements:

Minimum Academic Requirements

- You must have a graduate or postgraduate degree from a recognised university.

- Commerce graduates need at least 55% marks.

- Non-commerce graduates (like Science or Arts students) need at least 60% marks.

Age Limit

- There is no age limit to apply for the CA course after graduation.

Stream-wise Eligibility

- Commerce stream students with a background in Accounting, Finance, or Business are directly eligible.

- Non-commerce stream students are also eligible but must meet the higher percentage requirement (60%).

Once you meet these conditions, you can register for the CA Intermediate level through the Direct Entry Route, skipping the foundation level.

Explore our online programs to become future-ready

Transform your career with industry-aligned courses designed by experts.

CA Course Structure

The Chartered Accountancy course has three main levels:

1. CA Intermediate

This is the second level of the CA course. As a graduate, you can directly enter this stage through the Direct Entry Route. It includes two groups of subjects that cover accounting, law, taxation, and auditing.

2. Articleship Training

After registering for CA Intermediate and completing the required training (like ITT and Orientation), you need to do a 3-year practical training under a certified CA. This hands-on experience is called Articleship and is a key part of becoming a CA.

3. CA Final

Once you complete both Intermediate groups and at least 2.5 years of articleship, you can appear for the CA Final exam. This is the last stage of the course and tests your advanced knowledge and practical skills.

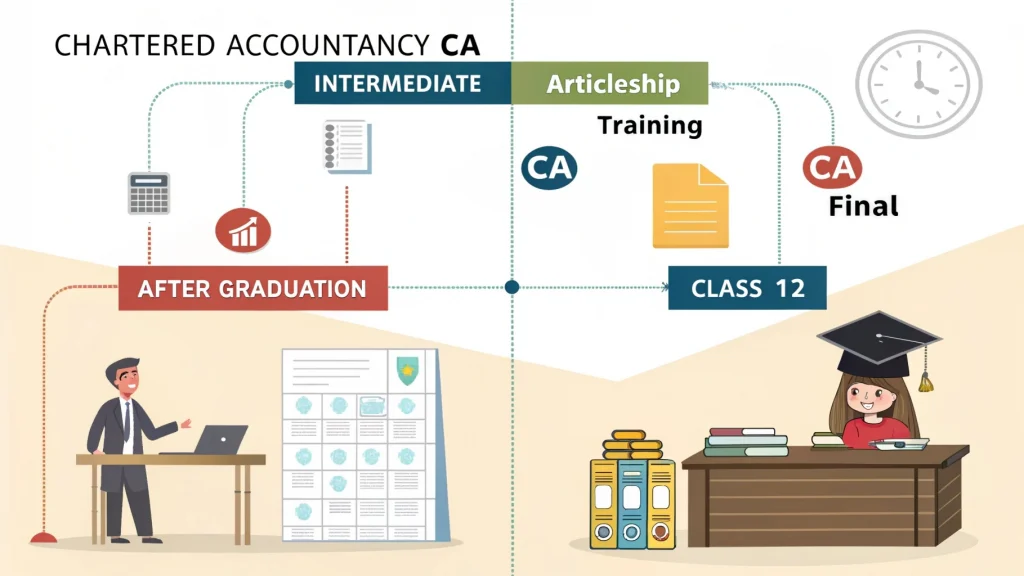

Difference Between Graduates and Class 12 Students

Criteria | After Graduation | After Class 12 |

Entry Level | Directly to Intermediate | Starts from CA Foundation |

Time Required | ~4.5 years | ~5 to 5.5 years |

Foundation Level Exam | Not Required | Mandatory |

Graduates save time by skipping the Foundation level, making the journey to becoming a CA a bit faster.

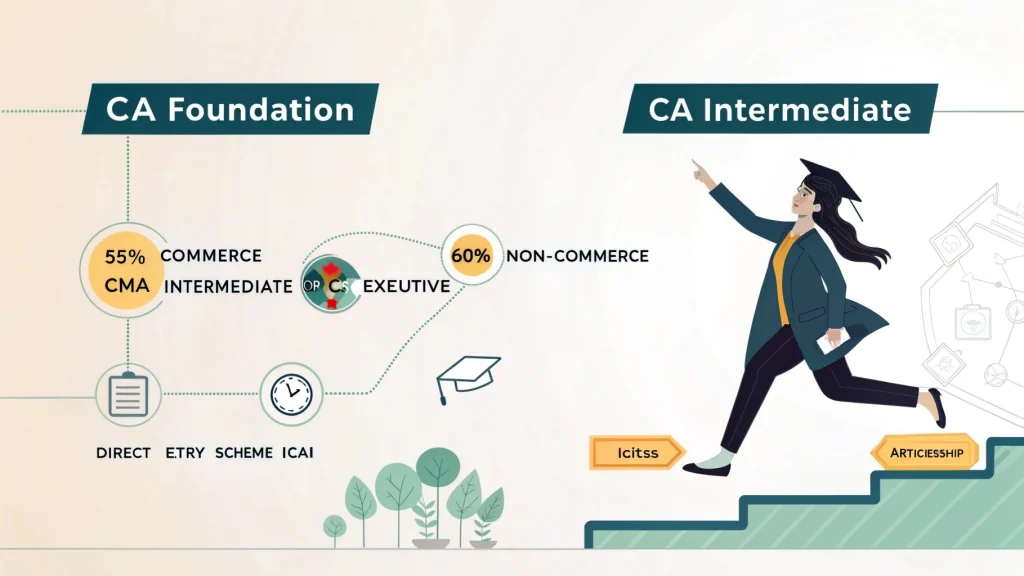

Direct Entry Route After Graduation

The Direct Entry Scheme is a special pathway that allows graduates to skip the CA Foundation exam and directly register for the CA Intermediate level.

What is the Direct Entry Scheme?

It is a fast-track entry option provided by ICAI (The Institute of Chartered Accountants of India) for students who have already completed their graduation.

Who is Eligible for It?

- Commerce graduates with 55% marks or more.

- Non-commerce graduates with 60% marks or more.

- Candidates who have passed the CMA Intermediate or CS Executive exams are also eligible.

ICAI Guidelines

- You must complete ICITSS (a 4-week training that includes IT and soft skills) before starting articleship.

- After registering for CA Intermediate, you can begin your 3-year articleship after completing ICITSS.

This route is perfect for graduates who want to save time and begin their CA journey directly from the Intermediate level.

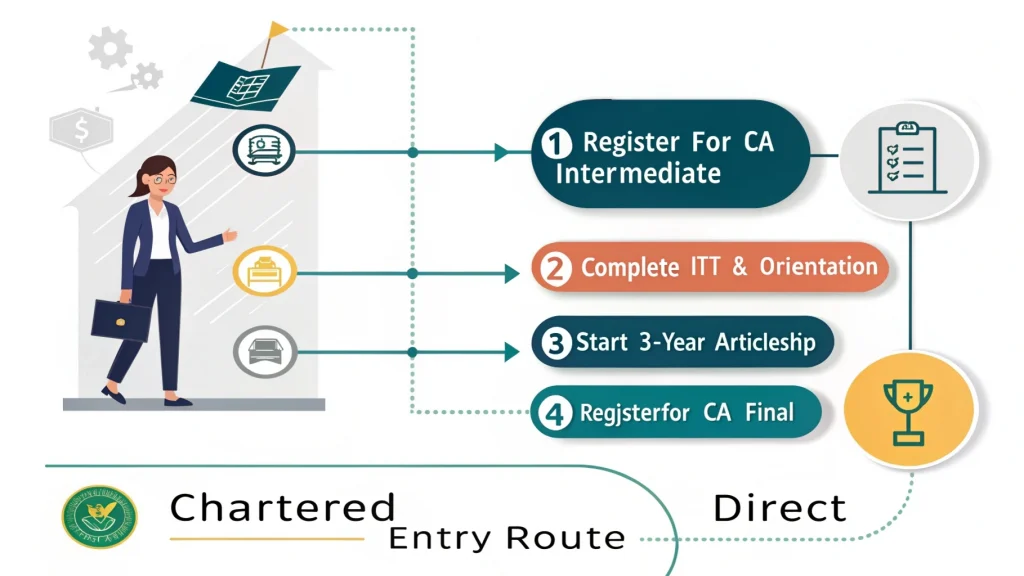

Step-by-Step Process to Become a CA After Graduation

If you’ve completed your graduation, here’s how you can become a Chartered Accountant through the Direct Entry Route:

Step 1: Register for CA Intermediate (Both Groups)

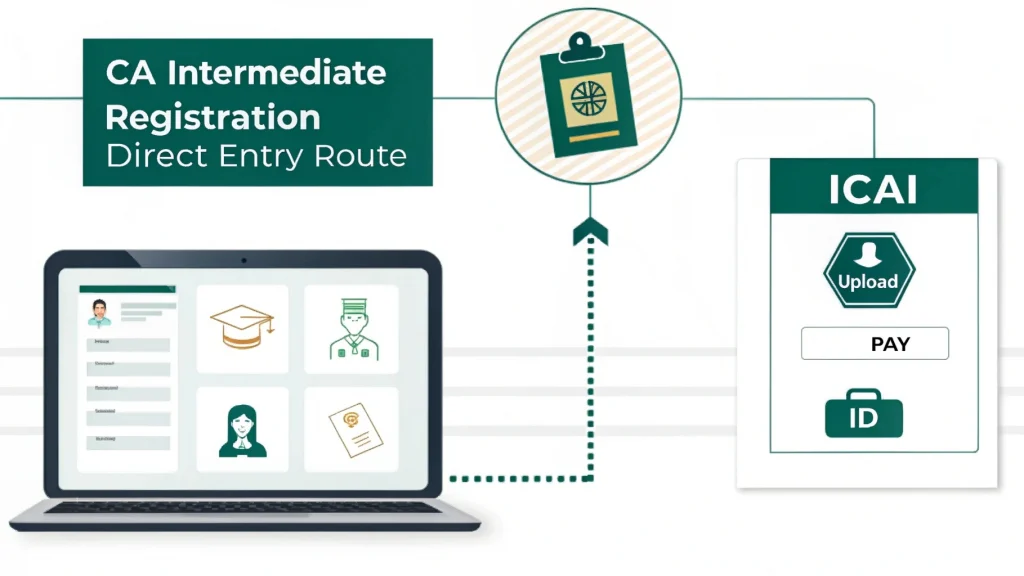

After meeting the eligibility criteria, register for both groups of the CA Intermediate course through ICAI’s official website. You’ll need to upload documents like your mark sheet, photo, and ID proof.

Step 2: Complete ITT and Orientation Program

Before starting your articleship, you must complete:

- ITT (Information Technology Training) – 15 days

- Orientation Program – 15 days

Together, these are known as ICITSS, and they help you build basic tech and soft skills.

Step 3: Start 3-Year Articleship

Once ICITSS is done, you can start your 3-year practical training (articleship) under a practicing Chartered Accountant. You also need to pass at least one group of CA Intermediate within this period.

Step 4: Register and Prepare for CA Final

After clearing both groups of Intermediate and completing at least 2.5 years of articleship, you can register for the CA Final exam.

Step 5: Pass the CA Final and Become a Member of ICAI

Once you clear both groups of the CA Final, you’re eligible to apply for ICAI membership. After that, you officially become a Chartered Accountant.

Documents Required for Registration

If you’re registering for the CA Intermediate course through the Direct Entry Route, you’ll need to submit some important documents.

List of Mandatory Documents

- Graduation Marksheet (self-attested copy)

- Passport-size Photograph

- Proof of Nationality (for foreign students)

- Aadhaar Card or other ID proof

- Signature scan

- Class 10th & 12th Marksheets (for age and qualification proof)

Make sure all your documents are clear, scanned properly, and in the correct format (usually PDF or JPEG).

Online Registration Procedure

- Visit the official ICAI website: https://www.icai.org

- Click on the Self Service Portal (SSP)

- Create an account or log in

- Select “Intermediate through Direct Entry”

- Fill out the online form with your details

- Upload scanned documents and photo.

- Pay the registration fees online

- Save the acknowledgment and application form for future reference

Once your documents are verified and payment is successful, your registration will be confirmed.

Duration and Timeline

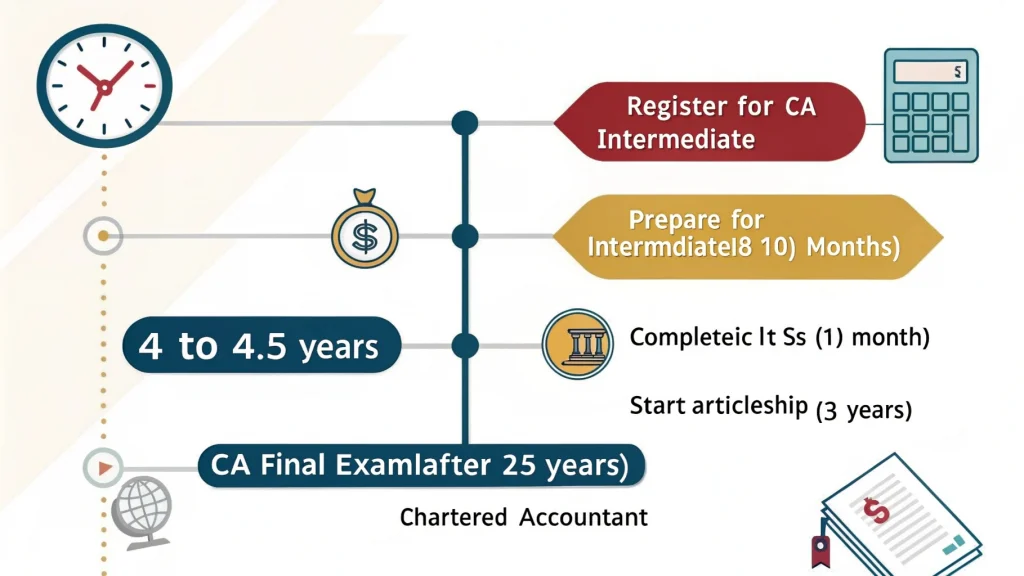

If you start the CA course after graduation, the total time to become a Chartered Accountant is usually around 4 to 4.5 years, depending on how quickly you clear the exams.

Total Time to Become a CA After Graduation

Here’s the average timeline:

- CA Intermediate – 8 to 10 months of preparation

- Articleship Training – 3 years (can start after ICITSS)

- CA Final Exam – You can appear in the last 6 months of your articleship

If you pass all exams on the first attempt, you can become a CA in about 4 years.

Fast-Track Options & Practical Timeline

Stage | Time Required |

Register for CA Intermediate | Immediate after graduation |

Prepare for Intermediate | 8–10 months |

Complete ICITSS | 1 month |

Start Articleship | After ICITSS |

CA Final Exam | After 2.5 years of training |

Total Duration | Around 4 – 4.5 years |

Tip: If you stay consistent with your studies and clear papers without delay, you can finish the course on time and start your career early.

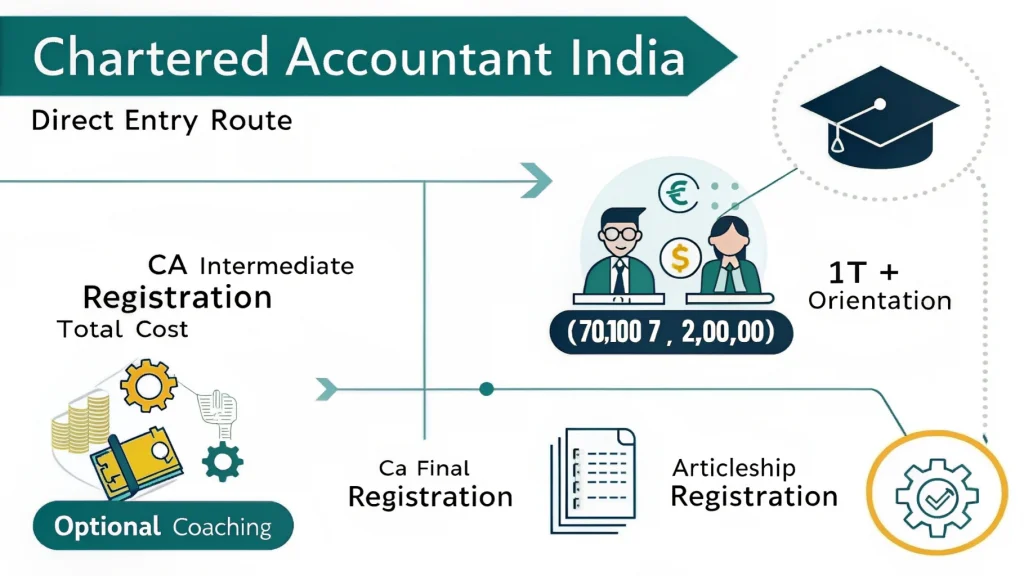

Cost and Fees Structure

The total cost of becoming a Chartered Accountant after graduation is affordable compared to many other professional courses, especially considering the value it offers in return.

Registration Fees (Direct Entry Route)

|

Fee Component |

Approx. Cost (INR) |

|

CA Intermediate (Both Groups) |

₹30,000 – ₹34,000 |

|

ICITSS (ITT + Orientation) |

₹7,000 – ₹9,000 |

|

Articleship Registration |

₹2,000 |

|

CA Final Registration |

₹38,000-₹40000 |

Note: Fees may vary slightly based on ICAI updates.

Training Costs and Other Expenses

- Study Material – Included with registration (soft copy/hard copy)

- Coaching (optional) – ₹30,000 to ₹60,000 per level (varies by location/institute)

- Exam Form Fees – Around ₹2,700 (Intermediate), ₹3,300 (Final)

- Miscellaneous – Stationery, internet, etc.

Total Estimated Cost (without coaching):

₹70,000 to ₹80,000 for the entire course.

If you join private coaching, the cost can go up to ₹1.8 to ₹2 lakhs in total.

Tips for Cracking the CA Exams

The CA exams are known to be tough, but with the right plan and consistency, you can crack them confidently—even on the first attempt.

Study Plan

- Make a Daily Schedule – Set fixed hours for study and revision.

- Target Each Subject – Divide your time wisely among all subjects.

- Solve Past Papers – Practice old question papers and mock tests.

- Revise Regularly – Keep at least 1–2 months only for revision before exams.

Tip: Don’t try to learn everything at once. Focus on understanding concepts and keep your basics strong.

Recommended Books and Resources

- ICAI Study Material – Always start with official ICAI books.

- Practice Manuals & RTPs – Great for exam-style questions.

- YouTube Channels & Free Videos – Helpful for quick concept clearing.

For some subjects, you can refer to:

- Taxation: TN Manoharan / VG Learning

- Audit: Surbhi Bansal / CA Ravi Taori

- Law: Munish Bhandari

Coaching vs. Self-Study

- Coaching is good if you need guidance, structured classes, and doubt-solving.

- Self-Study works well if you’re disciplined, understand basics, and can manage your time.

You can also combine both: take coaching for tough subjects and do self-study for the rest.

Career Opportunities After Becoming a CA

Once you become a Chartered Accountant, many career paths open up for you in India and abroad. You can either work for a company or start your own practice.

Job Roles in Companies

After becoming a CA, you can work in:

- Finance and Accounting

- Taxation and Auditing

- Budgeting and Financial Planning

- Internal Audit or Risk Management

You can join companies, banks, financial institutions, or even multinational corporations (MNCs). Roles like Finance Manager, Internal Auditor, Tax Consultant, and Chief Financial Officer (CFO) are common.

Practice as an Independent CA

Many CAs choose to start their own practice. You can:

- Handle tax filings and audits for individuals or businesses

- Offer financial advice, GST services, or company registration

- Build long-term clients and grow your firm

This path offers freedom, flexibility, and high earning potential.

Global Career Options

A CA from India can also work abroad with the right experience and certifications. Many Indian CAs find jobs in:

- Middle East (UAE, Qatar)

- UK, Australia, Singapore

- Big 4 firms (like Deloitte, EY, KPMG, PwC)

Some countries may require extra exams or licenses, but your CA qualification is highly respected worldwide.

Conclusion

Becoming a Chartered Accountant after graduation is a smart career move if you’re looking for a stable, well-paying, and respected profession. With the Direct Entry Route, graduates can skip the foundation level and start directly from CA Intermediate, saving both time and effort.

Yes, the CA journey is challenging — but with proper planning, regular study, and the right guidance, it is definitely achievable. Whether you dream of working with top companies, starting your own CA firm, or exploring international job opportunities, a CA qualification opens the door to many possibilities.

So, if you’re ready to work hard and stay focused, now is the perfect time to take the first step towards becoming a Chartered Accountant.

Leave a Reply