The three-year B Com General Subjects program teaches students basic commerce concepts in accounting, economics, and business law. During year one the BCom General Subjects training teaches financial accounting basics alongside business organization and business math which prepares students for future subjects. During your second year you will learn cost accounting alongside fundamental corporate law and business statistics alongside banking practices and market dynamics.

At the end of your studies you will pick marketing, finance, taxation, or human resources electives to show businesses your strengths and focus. Your understanding of basic BCom General Subjects prepares you for further advanced studies like an MCom or MBA along with professional certifications CA or CMA while also giving you options to work in businesses or start your own enterprise.

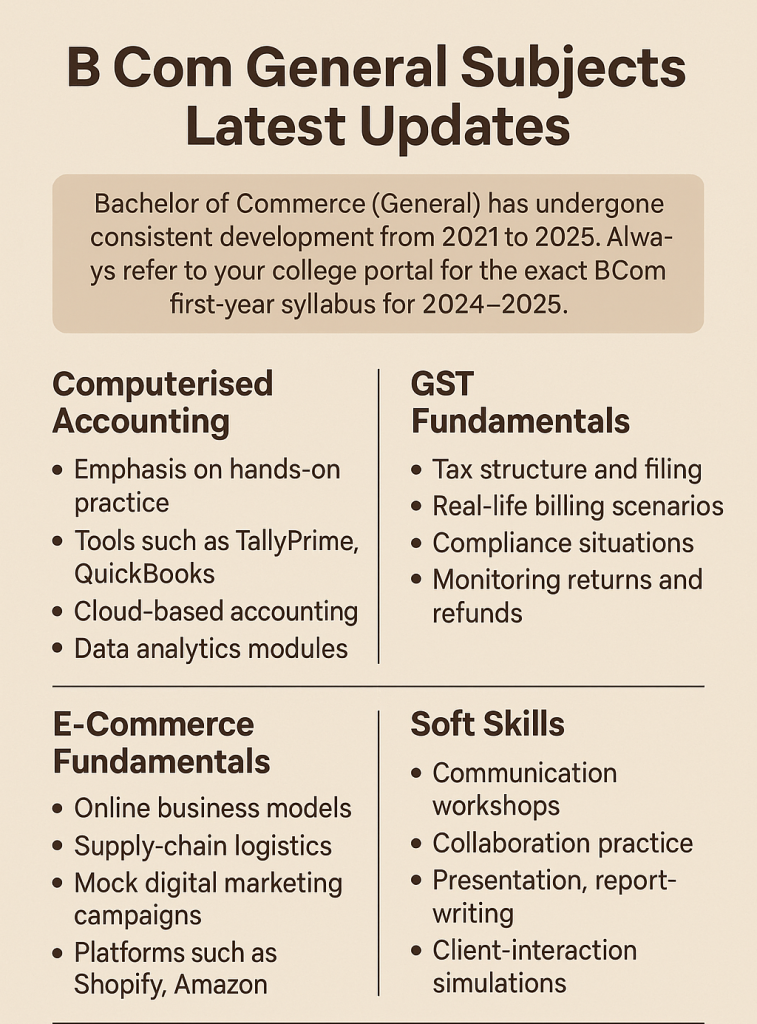

B Com General Subjects Latest Updates

Today’s colleges focus on teaching students practical accounting competencies. During your first year of study you will record transactions within TallyPrime while also reconciling them in QuickBooks desktop and cloud software and learn fundamental analytical tools including pivot tables and trend charts to extract business insights.

The central structure of India’s tax system lies in GST. Students learn about CGST/SGST/IGST taxation principles while creating model invoices and completing mock GSTR-1 and GSTR-3B submissions and tracking refunds through the system alongside compliance issue resolution. Your final exam will require you to determine input-tax credits while learning about GST’s impact on product pricing and the company’s financial gains.

An introduction to E-commerce includes understanding Business-to-Business/Business-to-Consumer operational models in addition to digital payment system providers Stripe and Razorpay and storage facilities and transportation services for final delivery. During this section students will create small marketing campaigns on Shopify and Amazon while simultaneously discussing data privacy and fraud prevention in digital money.

Soft-skill workshops enhance both your ability to communicate effectively as well as your teamwork abilities. Virtual collaboration joins forces with business writing as well as presentations report drafting and client-meeting role-plays and running mini marketing campaigns on Shopify along with Amazon systems. The 2024–25 syllabus details reside on your college portal so always verify there before cross-referencing against previous years’ contents.

Complete B Com General Subjects and B Com Honours

- Honours Specialisations: Advanced Financial Accounting; Corporate Law & Governance; Taxation (Direct & Indirect); Cost & Management Accounting.

- General Core Subjects: Financial Accounting; Business Law; Business Economics; Principles of Management; Computer Applications in Commerce.

- 1st Year (Semesters I & II): Financial Accounting I & II; Business Law I & II; Business Organization & Management; Business Mathematics & Statistics; Computer Skills for Commerce; Business Economics; Principles of Marketing; Environmental Studies.

- 2nd Year (Semesters III & IV): Corporate Accounting I & II; Cost & Management Accounting I & II; Income Tax Law & Practice; Auditing & Assurance; Business Statistics; Business Research Methods; Elective I (e.g., Computer Applications); Elective II (e.g., Taxation).

- 3rd Year (Semesters V & VI): Advanced Corporate Accounting; International Business; Indirect Taxes (GST); Strategic Management; Project Work/Internship Report; Elective III (e.g., Accounting & Finance); Elective IV (e.g., Economics, Computer Applications).

These are the subjects which many colleges are following since last 10 years but it may change according to the industry needs.

What are the electives of the BCom syllabus?

A Bachelor of Commerce (BCom) allows you to select a variety of electives so that you can specialise in a field that you wish to pursue in terms of career goals. Following is a more detailed examination of the most popular elective choices:

- Computer Applications in Business

Best suited for students who are interested in business and technology convergence.

Uncover software and computer applications powering modern business functions. This stream is ideal if you enjoy using computers and want to apply technical capabilities to business.

- Programming Languages – Uncover the basics of coding, often using C, Python, or Java, to understand how business software works.

- Enterprise Resource Planning (ERP) – Uncover multi-integrated systems that companies use to manage activities like inventory, finance, and HR.

- Tally & Accounting Software – Gain practical exposure to accounting software like Tally for live bookkeeping and financial reporting.

- Accounting and Finance

Suitable for those who intend to become a CA, CFA, or corporate finance professional.

Understand the financial concepts of business, from statement making to market research. This elective provides a proper platform for career opportunities in finance.

- Advanced Financial Accounting – Move past the fundamentals to manage sophisticated financial transactions and reports.

- Financial Markets & Institutions – Understand how mutual funds, financial institutions, and the stock market operate.

- Auditing & Assurance – Learn how internal and external audits are performed, risk evaluation, and guaranteeing financial integrity.

- Taxation

Great for future tax consultants, accountants, or government aspirants.

This course delves deep into tax laws and policies. It’s a practical and in-demand skill set in public as well as private sectors.

- Direct Tax Laws – Understand the income tax regime, calculations, exemptions, and planning for individuals and businesses.

- Goods and Services Tax (GST) – Understand India’s indirect taxation system, registration process, and compliance.

- Customs Law – Study import and export taxation regulations and how international trade is regulated.

How to Choose?

Think about your strengths and interests:

- Like technology and systems? Go for computer applications.

- Like numbers and money? Go for Accounting & Finance.

- Interested in law and compliance? Go for taxation.

Explore our online programs to become future-ready

Transform your career with industry-aligned courses designed by experts.

What are the syllabus of B.Com specialisations?

BCom Computer Application Subjects

- Fundamentals of IT

- Database Management

- Web Technologies

BCom Accounting and Finance Subjects

- Corporate Finance

- Security Analysis

- Financial Derivatives

BCom Taxation Subjects

- Income Tax Planning

- International Taxation

- GST in Practice

What is the Difference Between the Syllabus of BBA and BCom?

BBA Syllabus Emphasis:You start managerial and leadership roles immediately after completing our BBA program. The curriculum provides instruction on how organizations function (Organizational Behaviour) and shows you how to develop market entry strategies (Marketing Management) and recruit essential personnel (HR Management) while optimizing your supply chain infrastructure (Operations & Supply Chain).

Theory books give way to actual case studies which showcase why businesses fly or flounder.

Through hands-on group projects combined with in-class presentations students learn to make quick decisions and develop strategic capabilities.

We guide your business communication development as well as soft skill growth by teaching you to create reports and perform pitches and negotiate effectively before preparing you to become a confident executive.

BCom Syllabus Emphasis:Students in BCom’s first-year curriculum learn fundamental subjects comprising Financial and Cost Accounting together with Business and Corporate Law and Business Economics and Statistics as well as Taxation (direct and indirect) and Auditing. Although BCom’s first-year classes include theory they also provide practical training with accounting software and spreadsheet tools which helps students develop number-fundamentals and regulatory knowledge. Your ability to read financial statements together with tax preparation work will fix your foundation in financial reporting while complying with necessary regulations.

Choosing the Right Way. Depending on your professional aspirations, your choice is made.

- If you aspire to manage people, operate projects, or head marketing campaigns, BBA is cut out for you.

- If you have aspirations in banking, finance positions, chartered accountancy, or tax consultancy, BCom provides you with the basic training. Both the courses equip you for postgraduate studies. A BBA can result in an MBA or in specialised management courses. A BCom can result in an MCom, CFA, CA, or CMA

What are the top BCom books?

BCom 1st Year Books

- Financial Accounting by T.S. Grewal

- Business Law by N.D. Kapoor

BCom 2nd Year Books

- Corporate Accounting by S.N. Maheshwari

- Cost Accounting by M.N. Arora

BCom 3rd Year Books

- Advanced Auditing by R.G. Gupta

- International Business by P. Subba Rao

Conclusion

In short, a commerce degree is very versatile. BCom General gives you a basic grounding in accounting, law, economics, and management. BCom Honours lets you go deeper into finance, taxation, and governance. You’ll be exposed to computer-based tools and e‑commerce in modern curricula. A BBA is all about leadership, strategy, and real-world case studies. Choose based on what you’re passionate about and want to do professionally. Whether it is banking, corporate finance, project management, or advanced studies, there is something for all. Work your college course. Think about which type of jobs you like. Then choose the degree that best suits your aims.

Leave a Reply